Download:

Abstract:

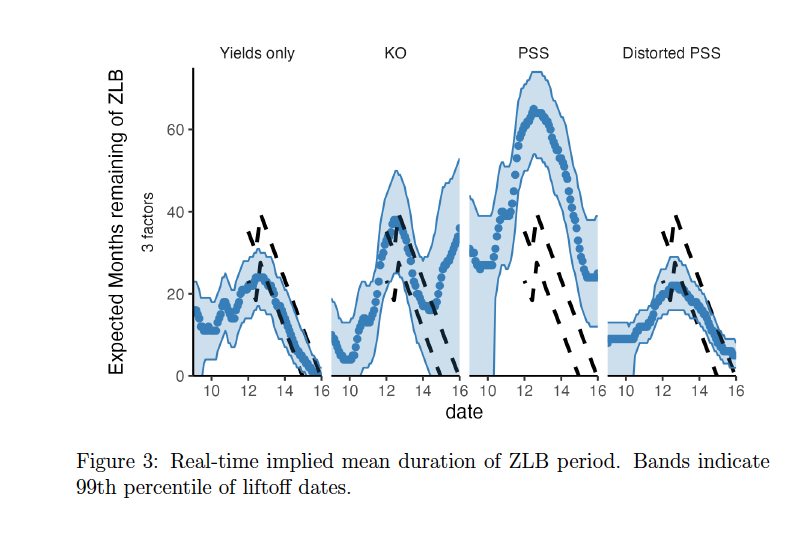

We examine the channels and efficacy of monetary policy at the zero lower bound (ZLB) through the lens of various shadow rate models. Our key methodological contribution is to extend the discretization filter to incorporate missing observations. This allows us to estimate shadow rate models that both incorporate survey forecasts and allow for departures from rational expectations. Although the models disagree about the level of the shadow rate and the duration of the ZLB in real time, they are consistent in attributing most of the effects of major Federal Reserve policy announcements to changes in term premia. We estimate small macroeconomic effects of shocks to the shadow rate relative to prior estimates, but this is due to differences in the sample, not the shadow rate estimation.

Citation

Ethan Struby & Michael F. Connolly, 2024. “Shadow Rate Models and Monetary Policy,” Working Papers 2022-03, Carleton College, Department of Economics.

@TechReport{CS_shadowrates,

title = {Shadow Rate Models and Monetary Policy},

author = {Connolly, Michael F. and Struby, Ethan},

year = {2024},

institution={Carleton College, Department of Economics},

type={Working Papers}

number={2022-03}